There are two things certain in life: death and taxes. But in New Zealand, there is a third - getting overtaxed. The chances are, if you've ever worked in New Zealand, then you will have definitely been overtaxed. But the question is, how do you get your money back? In New Zealand, there are different tax brackets based upon how much you will earn in a year and how much you will get taxed accordingly. For the 2016-17 financial year, the brackets are as follows. If you need percentages for a previous financial year, you can go and check out the link below, which will show you all the information you need. As an example, for this financial year, if you were to earn sixteen thousand dollars, you will get taxed 10.5% on the first fourteen thousand dollars and then seventeen and a half percent from the remaining two thousand dollars. However, if you've ever looked at your payslip in New Zealand, you will have noticed that you'll probably be taxed more than what you should be. This is because your two-month temporary job is extrapolated to a whole year's worth of earnings, and they tax you based upon this number, not what you actually earn per week. I'm going to briefly go over an example, but if you want a more detailed guide, we have a very awesome blog post link down below that you can check out. In this video, I will be covering how to get tax packs for previous financial years, and I'll be covering that a little bit later. The big question is, how do you get your money back? The answer is a beautiful twelve-page long form. The form, which I've linked down below from the IRD website, is quite long and sometimes a little bit confusing. It...

Award-winning PDF software

Irs refund number Form: What You Should Know

Refund Inquiries | Internal Revenue — IRS Sept 27, 2025 — The following dates are important for filing refunds. If you filed using Form 4968 with your 1040EZ, you'll need to file a Form 4968, Form 4868, and Form 4868B If you filed using 1040A, 1040PX, 1045, 1040, etc., you will need to file an amended tax return (Form 4968). If you filed using Form September 11, 2025 — Call the Refund Service Center, and you'll get a letter telling you owe money or that you'll have no further action for a period of time. If you're ready to file a refund check with us, we will process your refund checks as quickly as we can. (We try to mail you any refund checks that we have, but they may not show up in your mailbox for some time.) If you are not ready to file a refund check, you can still give us an honest answer to questions. We will be happy to review the information and help you figure out what you owe us. You need to send us your tax return information, including the amount of cash, check or credit you received in the filing year. If you are paying by check or credit card, we will do our best to figure out your payment method, and we will send the refund automatically in the mail. Remember, all we want is for you to pay that amount back right away, and we will help to put the right amount in your checking or credit account. But keep in mind: we'll charge you a credit card transaction fee, which goes to help support this program. You can avoid this charge by using online services to pay over the phone. Check with it at the end of the year and see if there's a charge that could go away if you pay online. If there is none, the payment will typically take from a few weeks to a few months for processing. After you've received your refund, you should send it to us in the form of a check or credit card payment. If you haven't received a refund check, you can call, or you can mail it to: Refund Requests| IRS Office Of Taxpayer Advocate For The Elderly U.S. Department of Treasury P.O.

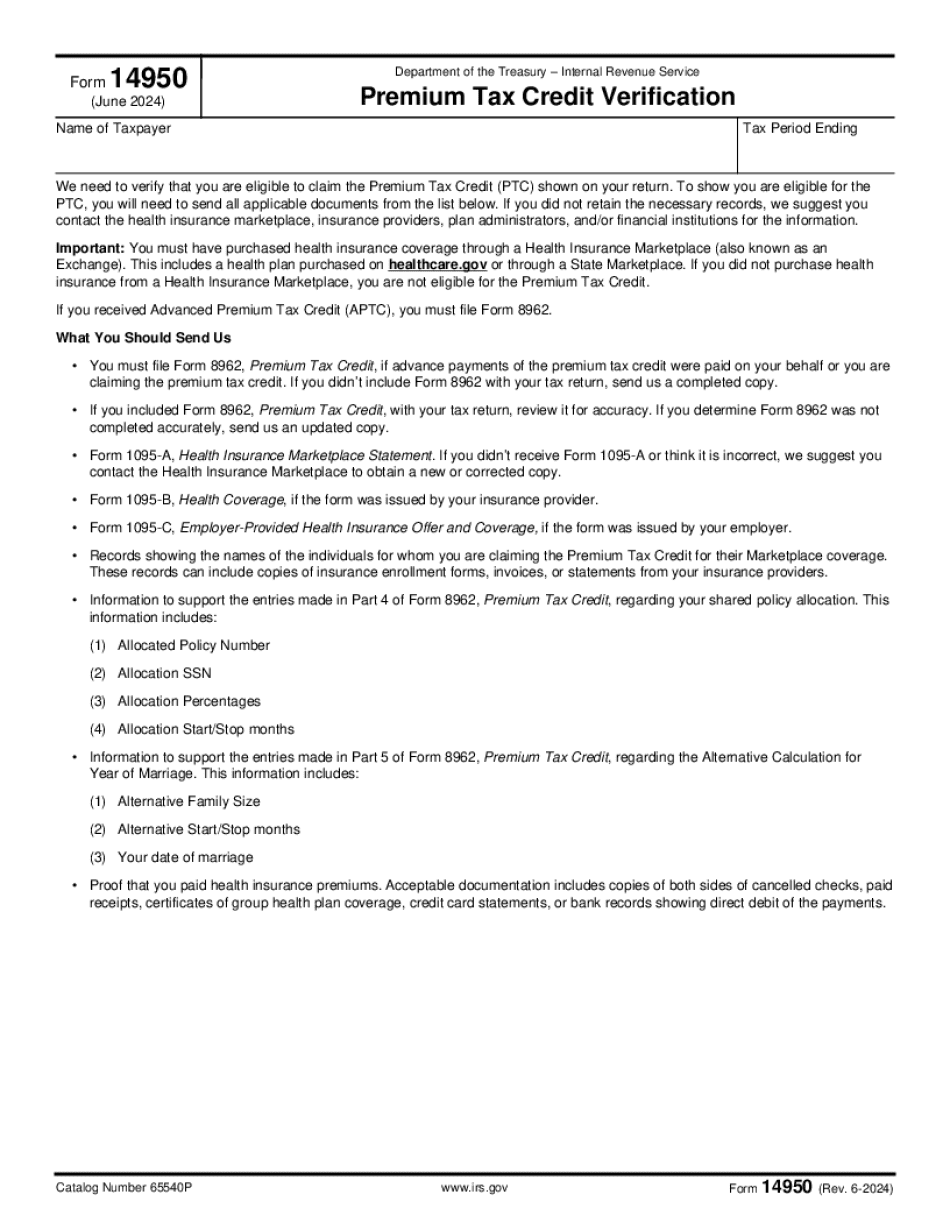

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14950, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14950 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14950 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14950 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs refund number