Hello, welcome to a Coding Rainbow video! The topic for this video is Rita. What is Rita? How can I use it? How can you use it? Who are you? Who am I? I don't know the answer to these questions, but I'm going to attempt to talk about all of them. Rita is a software toolkit for computational literature. It is developed by Daniel Howe. It is an open-source project that you can find on GitHub. You can use it with a variety of platforms, most notably Java and the Processing programming environment, as well as JavaScript in the browser or with server-side programming with Node. If you dive into it more, you might find that there are other ways of approaching using Rita. But what I'm going to do in this video is show you how to use Rita with client-side JavaScript with p5.js and what kinds of strange and interesting language experiments you can make. Rita has a wide variety of functionality, so I'm going to click here to the reference. And you can see, "Oh my goodness, look at all these functions! There's so much I can do with it." But let me talk about two key aspects of the Rita library. One is there is an object called a Rita string or RI string. This is something that you can feed your own text into. If you take your string and make it a Rita string, then you can analyze that string. You can say things like, "What are the parts of speech of these words? How many syllables do each word have?" You can analyze this particular string of text in a variety of ways. Another thing that Rita has is a Rita lexicon. What is a lexicon? This is a key term for...

Award-winning PDF software

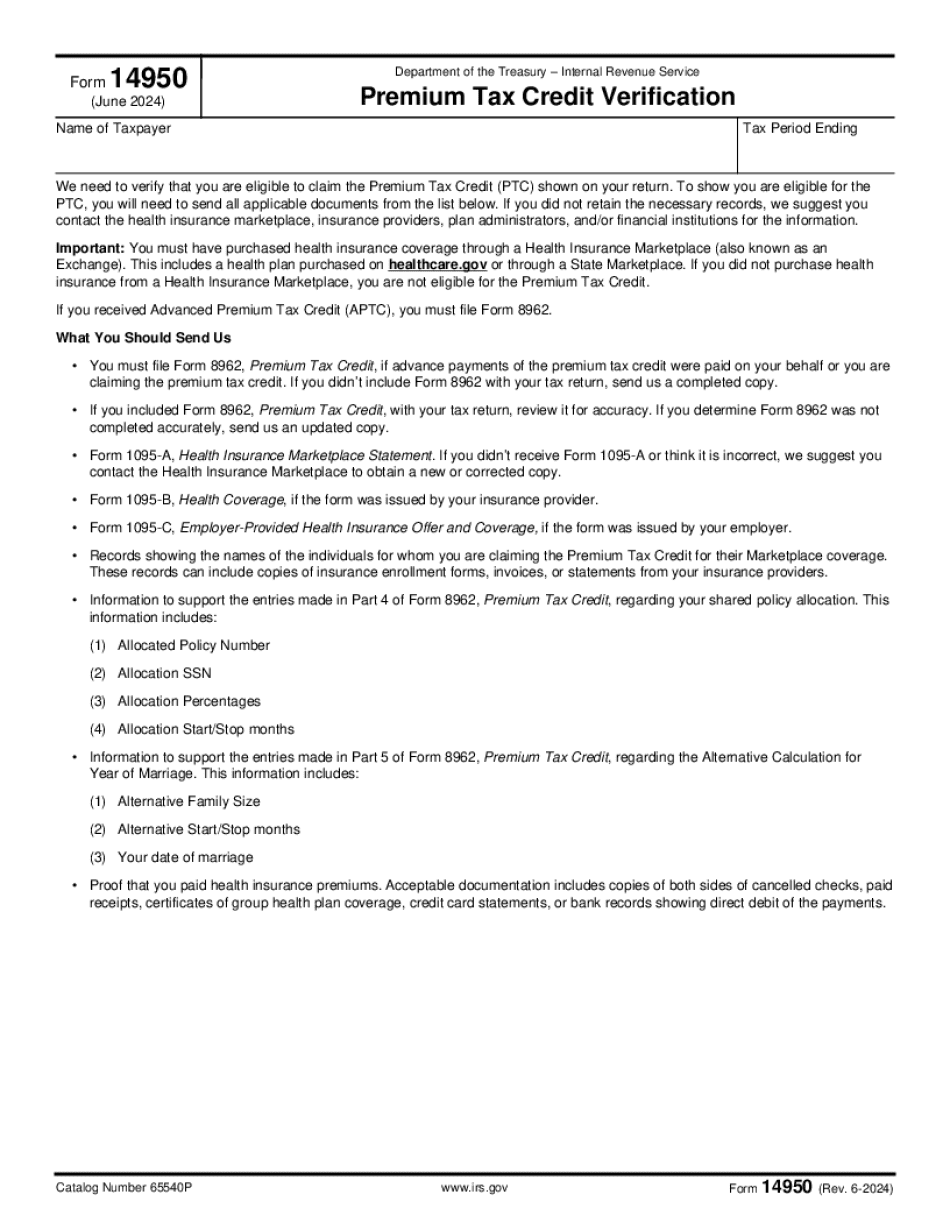

14950 Form: What You Should Know

Department of the Treasury by the person filing the tax return with respect to the partner's share of the partnership's income, or the partner's share of the partnership's income, deduction, credit or loss from business. See Form 941 — Partner's Share of Partnership Income and Deduction or Form 941 — Partner's Share of Partnership Expenses for more information regarding Forms 941 and 941A. Do whatever you want with a Form 941 — partner's share of partnership income or deduction or Form 941 — partner's share of partnership expenses. Securely download your document with other editable Form 941 — Partner's Share of Partnership Income PDF — Formal A Form 941A — Partner's Share of Partnership Expenses PDF — Formal A Form 940 — Partnership Income Information Download PDF — Formal A Form 940-A — Partnership Expenses Download PDF — Formal A Form 8962-PTC Verification Generally, the Form 940-PTC is an information return required by the Internal Revenue Service to be filed by a domestic partnership to obtain an adjusted gross income credit on the partnership's U.S. federal income tax returns for 2014, 2015, and 2016. Please read the attached verification form and attach the completed form with a completed Form 941A to your return and send to: U.S. Department of the Treasury IRS Form 840-5 — Partnership (Revised) Form 8951-PTC Verification The Form 8962-PTC is an electronic or paper copy return with which the partnership is required to verify certain information on the partnership's U.S. federal income tax returns for 2014, 2015, and 2016. See Form 941-PTC — Partner's Share of Partnership Income and Deduction or Form 941-PTC — Partner's Share of Partnership Expenses for more information regarding Form 941. To secure the Form 8962-PTC, you must fill in and complete the Verification of IRS Form 8892-PTC at the IRS website. This document may only be used once. Securely download your other editable Form 8962-PTC PDF, Formal A Partner's Expense Verification Form 941 will be used to identify the U.S.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14950, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14950 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14950 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14950 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 14950